With the new tax year almost upon us, the IRS once again released its top 12 scams that people fall for. Today Tech2U will go over the list and help you better protect yourself from fraud.

The most common form of tax scam that has topped the list for several years is identity theft. A scammer will steal your Social Security number and file a tax return claiming a fraudulent refund. They will often do this early in the year and when you go to file your legitimate return, the IRS will notify you that your return has already been processed. The criminals might also request a pre-paid credit card using your SSN to avoid having a bank account attached to it and charge it to the max against your name.

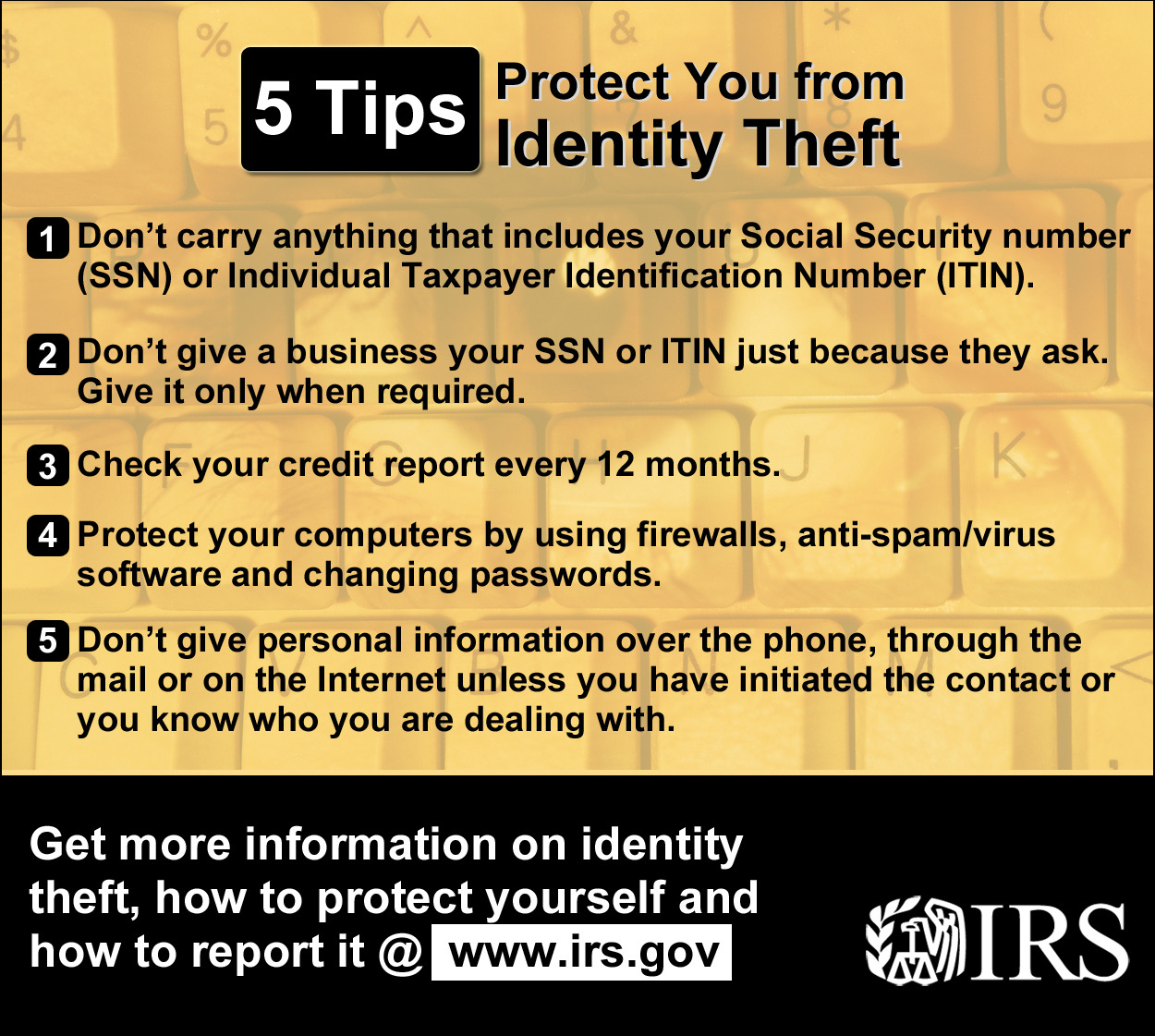

Most of these scammers get your information through phishing schemes. Luckily these types of schemes are completely avoidable and with these tips you can better protect yourself from phishing

- Never give out your Taxpayer ID or social security number unless you trust the party and it is absolutely necessary

- The IRS will never call you so don’t ever give away personal information on the phone

Phone scams are when criminals call you for no apparent reason and will impersonate the IRS. They might aggressively threaten and demand the potential victims for payments on fictitious penalties and can even appear on caller ID as the IRS. They might threaten police arrest, deportation, license revocation, or legal and financial troubles. Criminals will often prey on those most vulnerable such as the elderly, recent immigrants, and those whom English is a second language.

So how can people tell when a call is a scam or not? Five things the IRS does NOT do that scammers will do are:

- The IRS will never call you randomly. They will always communicate by mail first

- You always have the right to question and appeal any un-paid taxes

- The IRS will never dictate how you can pay for taxes or penalties

- They will never ask for any credit card information over the phone

- The IRS will also never threaten imprisonment

Scammers can also employ websites and emails to phish information from. They set up fake websites that can might look like IRS.gov that will take any information you enter in on them and use it maliciously. There are a few things to look for to make sure you are using a trusted site or responding to a legitimate email address. The IRS will never start conversation over the phone. In almost all cases the IRS will contact you in writing first. Some other tips to keep your personal information safe in general are:

- Always use a firewall on your personal networks

- Mix up your user name and passwords across sites

- Update your anti-malware software

- Use encryption on your personal data

- Always look for https in front of the URL if you are giving a site personal information

- Check your credit report every 12 months

It is a tricky world out there and trusting the websites and emails you receive is challenging. But following these tips we have outlined will help keep your financial and personal data secure.

Be sure to like Tech2U on Facebook and Follow us on Twitter for more updates and articles like this one!

Video Transcription:

Speaker One: Dirty Dozen Top Tax Scams they’re the ones tax payers to be watching out for. Many of the top tax scams involve crooks using technology to deceive victims. Jason Davis is here from Tech 2U to tell us all how to avoid becoming a victim. Are they are getting really sophisticated every year, they get better?

Jason: Not necessary better but they definitely using technology more to their advantage these days. I might seem a little out of my element here but it’s actually pretty pertinent because they use email and fake websites to get information using all type of bad ways.

Speaker One: The fake websites are really good. I guess what we want to let people know, you won’t get a call from the IRS, if you get a call from the IRS it’s not the IRS.

Jason: Right, if you get a call from the IRS it’s most likely not them. They are always going to get you with written correspondence first.

Speaker One: Absolutely.

Jason: Also the IRS won’t demand that you pay anything without letting you question or appeal it.

Speaker One: So what other phishing things are going Jason that people should watch out for?

Jason: Well the top one on our list is tax related identity theft. What they will do is they’ll use a phishing email or website and what that is a set up a fake website right, they send out emails to potential victims indicating that their fines due or they owe personal penalties. The website and address will be linked in an email and it will say IRS.gov and it’ll look completely legitimate. But when you click the link it will take you to a fake website. So whatever information you enter on that website or respond within that email they’re going to either sell it to a criminal or use it for identity theft themselves.

Speaker One: How do you know if it’s a fake website or a fake email?

Jason: Well it can be kind of hard, but the IRS will never initiate contact to you via email.

Speaker One: Okay, so no phone call, no email

Jason: Right. Unless you email them first they might respond to your email or if you call them first they might call you back. But if the IRS is reaching out to you first, it’ll always be with a written correspondence, a letter.

Speaker One: Okay so that’s helpful to know. If you get a phone call from the IRS or an unsolicited email from the IRS, it is not the IRS.

Jason: That’s right.

Speaker One: So how do we all keep our personal information safe?

Jason: Use a firewall on your home and business networks. Don’t use the same user name and passwords across multiple accounts. That’s a really big one, because if they get one then they have access to all of your information.

Speaker One: Okay, do they assume most people keep one for everything?

Jason: Well, I mean I don’t know if they assume it but it is a pretty common practice of using the same user name and same passwords. I’m guilty of it and some in cases, but since I started working with Tech 2U and Nerds On Call that’s been a long gone. You got to mix it up.

Speaker One: You get sent on time off for stuff like that don’t you? You have to be a leader Jason, you have to be a leader on that. What other things, credit reports, what can we look for that would help?

Jason: What you can look for if you’re online is what’s called a secure certificate on the websites, in the beginning where it said http make sure there’s an “S” right there. So it’s https. That means that the website has earned a secured certificate, it’s been verified and it’s safe to enter personal information on it.

Speaker One: The bad guys can’t fake the “S”?

Speaker Jason Davis: Right, they can’t because it actually takes a lot of work to get the “S” on there. Has to be verified multiple times.

Speaker One: So the “S” is for real.

Jason: Right.

Speaker One: In this case.

Jason: Right.

Speaker One: Okay what’s your app of the week ?

Speaker Jason Davis: The app of the week this week is called the Zip app. Its kind of a fun app for parties or ice breakers. Everyone gets it on their phone and you download it and it asks questions, like you pick one or truth or love you know. Basically it’s anonymous, you put your opinion in and you compare it to how others answered. So it’s really cool to give you like pick up line material or just sound smart at a party based on what you answered.

Speaker One: You’re taking this whole thing in a completely different direction than we used to. Wow pick up lines at parties, your app of the week. If you’re married it can certainly get you into a lot more trouble then you need to be in. All right Jason we thank you so much.

Jason: Thanks all.

Speaker One : Tech To You. Amy to you.

Speaker Amy: I love that, I want to use it . All right thanks guys.

Speaker One: Good Luck with that.